We know there is nothing more stressful than delayed payments on closing day. Luckily, there are ways to optimize your work in SureFund to help avoid problems or delays when entering disbursements. You’ll be more productive and your clients will appreciate your efficiency!

Remember these important steps when entering disbursements in SureFund:

Step 1.

Check if the Payee is in SureFund’s database. If a Payee exists in the database, the Payment Type (EFT, Cheque, Wire) will default to the method stipulated by that Payee and cannot be changed.

Step 2.

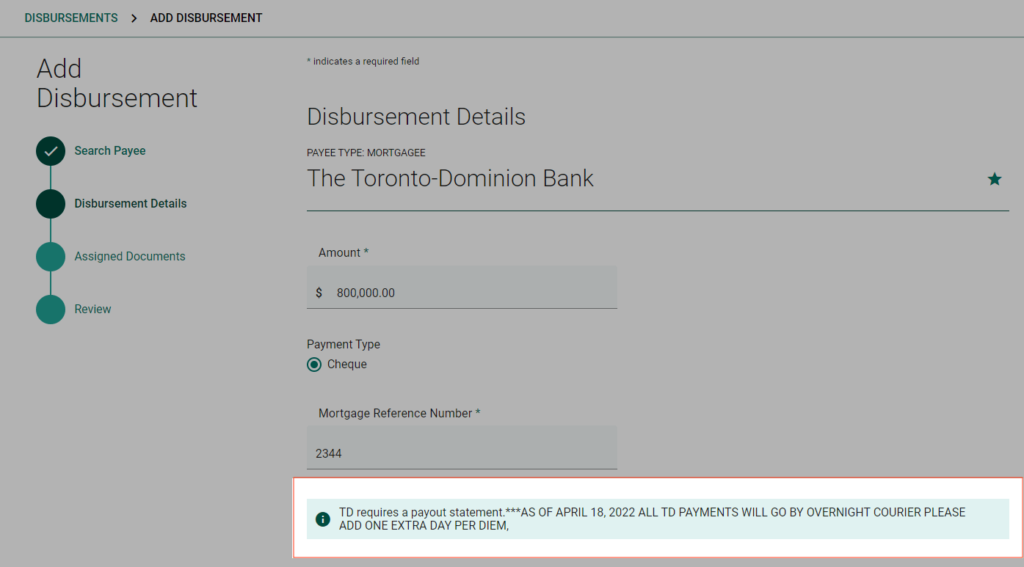

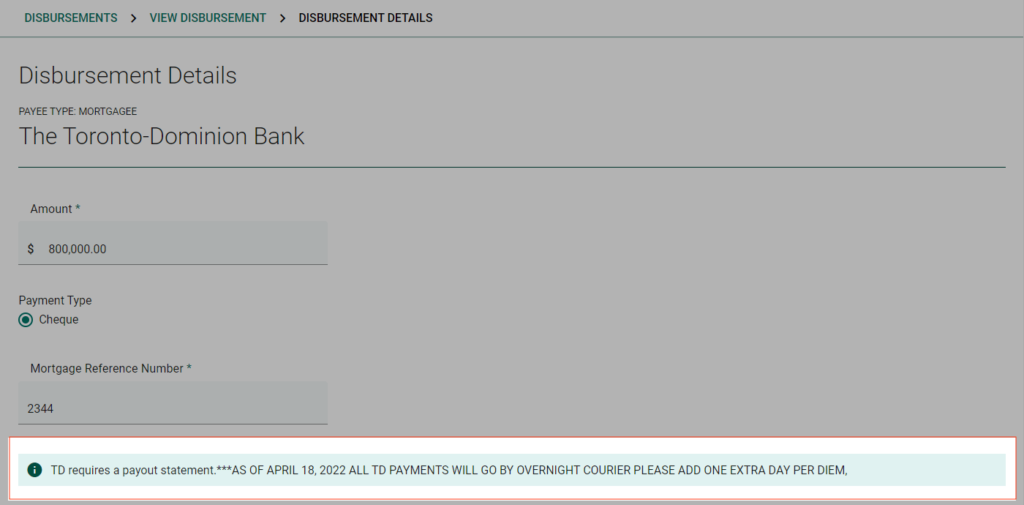

Check the comments section for important notes and instructions from that Payee on the disbursement. These notes can change rather quickly and without much notice depending on the Payee, so make sure you review this section even if you often select the same Payee.

Tip! Comments can also be viewed afterwards on the Disbursements Details page.

Step 3.

Make sure existing Payees are not entered manually. If you attempt to submit a deal for an existing Payee entered under Payment Type “Other” instead of selecting Payee from the SureFund database, the disbursement may not be accepted or the FI’s required documents may be missing or incomplete. There may even be delays in processing the payment.

Disbursements for major financial institutions (FI) will always be paid according to the FI’s preferred method – even if the disbursement is entered manually. For example, a mortgagee may default to “Cheque” as the payment type, but the comments section may have a disclaimer stating, “Next business day delivery via wire as per lender requirement”.

By employing these best practices, SureFund will help you save time managing your closing day transactions all in one place.

If you have any questions about payment types in SureFund, please do not hesitate to contact info@surefund.ca